I’m a huge fan of utilising the latest and greatest disruptive technologies. Not just because they improve competition between businesses, but usually because they offer a lower price point and some form of additional value.

Let’s take Netflix – ~$12AUD per month and I tend to watch 6-8 films per month, mainly with my kiddies. Compare that to a cinema where a film costs ~$20AUD, however it is on a big screen with surround sound, but it’s expensive to take the kiddies. Or compare with a video rental of around ~$5AUD per film when you could actually rent DVD videos from Blockbuster Video….that’s another story in itself on Wikipedia.

Another example is Uber – $22AUD per trip into the Brisbane CBD, compared to $35AUD for a taxi ride. Uber is cheaper, cleaner, don’t smell and the drivers are friendlier.

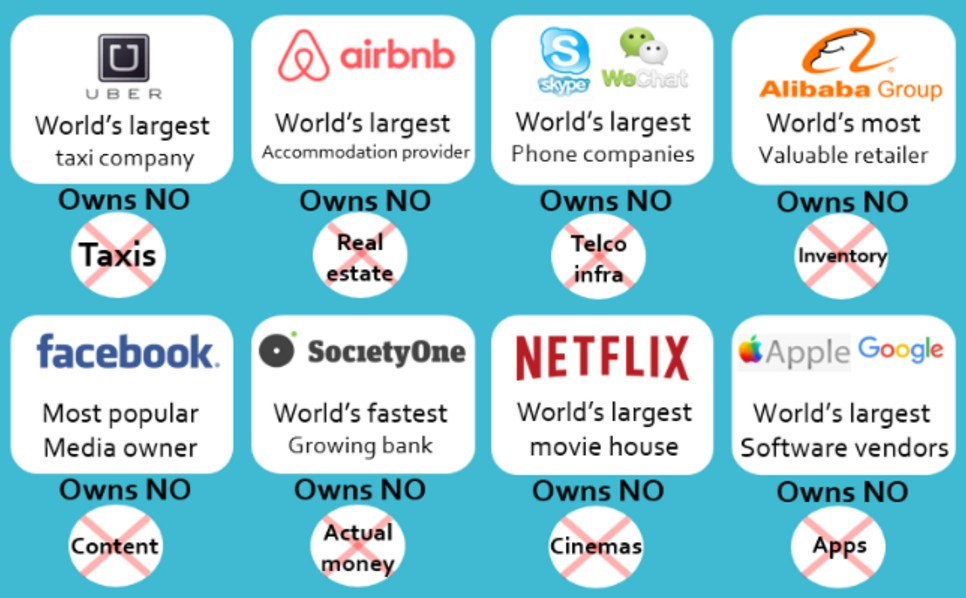

Here is a quick glance of a range of new disruptive companies that have emerged over the past few years. Important to note that they don’t actually own the product that is consumed by the customer, they utilise third parties to provide the products as part of their value stream.

So…does this pattern hold true for all disruptive technologies?

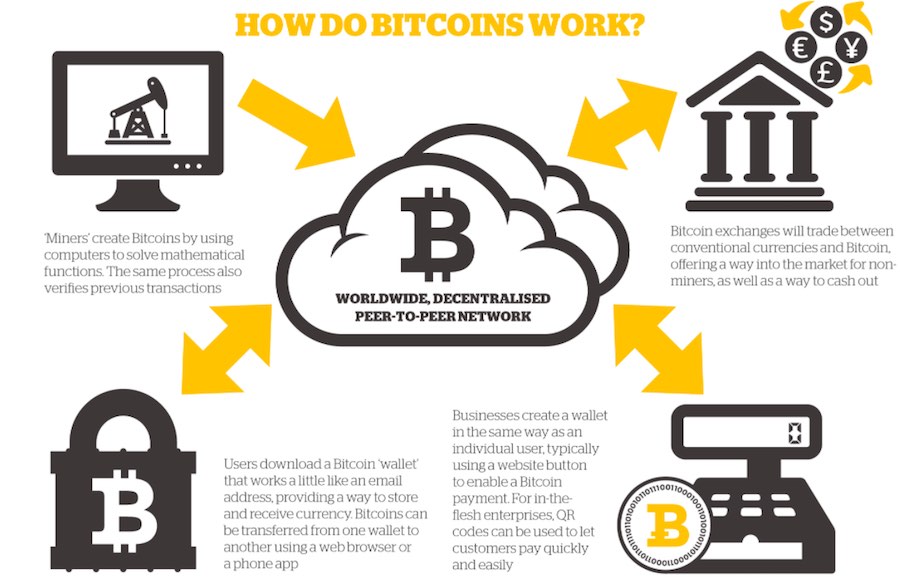

Let’s look at Blockchain technologies, specifically the purchasing of Bitcoin. This one is a little different, because it’s yet to fully disrupt, displace or compete with the Australian Dollar (AUD) or the ASX share market.

Is it cheaper? It’s difficult to compare as price is not relevant here. Does it provide more value? Not really, if you consider that I can’t spend Bitcoin in many places, unlike my credit card or cash which is accepted everywhere in Australia, online and abroad.

Maybe comparing Bitcoin against my credit card and cash is non-sensical. Maybe it’s really an investment, maybe it’s like shares. I think the best way to find out, is to buy some Bitcoin. A small amount to help me understand the technology…so where do I start?

How does Bitcoin work?

For me the best place to start with any investment is to talk with my financial advisor. This is where the problems started. “Where can I buy Bitcoin?” I asked, confident I’m receiving what I asked for…..ermmm…. nowhere.

Why is that?

Well if you go into the ANZ Bank and you want to buy currency they have safeguards in the form of a specific financial legal acts that ensure you’ll get real currency and any charges are transparent.

When you go to a Bitcoin merchant, they’re not covered by any specific financial legal acts, so you can’t be 100% sure you are getting what you paid for. Also Bitcoins are virtual. It’s true you can see them in your virtual wallet, but there are no guarantees that you won’t be duped either in buying the Bitcoins or selling them.

But if you assume that it’s more like shares, does that help? Well shares are listed on a stock exchange and are regulated by various acts in that country. The most well-known is the Sarbanes-Oxley ACT (SOX) which covers the listing of shares on the US stock exchange. Unfortunately for Bitcoin, it’s not covered by the same safeguards.

So, what do I conclude? Well I can buy Bitcoins from several merchants, but it’s difficult to assess what safeguards are in place, should I make a lot of money from the transaction.

Anyhow, I’m happy with using my credit card and cash for purchases and I’m happy to continue investing in a balanced portfolio of shares, as well as using Netflix for kiddies’ films and Uber for rides into the city.

Did I tell you about the time I discovered the Amazon Kindle and Agile Principles…….?